30+ Oregon Property Tax Calculator

Oregon has eigentumsrecht tax rates that are nearly inches line with nationals means. Web Select your filing status.

Washington County Or Property Tax Calculator Smartasset

Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

. Web SmartAssets Oregon paycheck calculator shows your hourly and salary income after federal state and local taxes. Heres a list of how Oregon property tax is calculated. Enter your info to see your take home pay.

Web The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. Web Overview of Oregon Taxes. Enter your details to estimate your salary after tax.

Press calculate to see the average property tax. Todays Mortgage Rates 51 Arm. The passage of Measure 5 in 1990 instituted limits on the amount of tax that can be.

Web Oregon Estate Tax. Web The property tax system in Oregon has been heavily influenced by Measures 5 and 50. Web The total amount of tax placed on a property is computed by multiplying the propertys assessed value by the combined tax rates of all the districts in which the.

Your Assessed Value is multiplied by the. Web Two calculations are performed each year to determine your property tax amount. Web To calculate your property taxes start by typing the county and state where the property is located and then enter the home value.

Property taxes rely on county assessment and. For comparison the median home value in. 087 of home value Tax amount varies by county The median property tax in Oregon is 224100 per year for a home worth the median value of 25740000.

Your tax bill is always the lower of these two amounts. Web Oregon Paycheck Calculator 2023. Everything You Need to Know SmartAsset Financial Advisors Home Buying How Much House Can I Afford.

Other tax laws or Oregon Department of. The effective property tax rate in Oregon is 082 while the. Web Calculating Oregon property tax involves several steps and factors to consider.

Web Our Lincoln County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Web Our Oregon Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Simply enter your wages tax withholdings and other information.

Web Use our income tax calculator to find out what your take home pay will be in Oregon for the tax year. Web While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and. Use this calculator to estimate your net or take home pay in Oregon.

Mortgage Rate Buydowns By Homebuilders Are Now All The Rage To Prop Up Sales Lowering Effective House Prices In A Big Way But Don T Get Picked Up By House Price Data Wolf

Bloomington Estimates 1 4m Increase In Tax Revenue For 2023 Wglt

Ohio Auditors Resist Legislative Answer To Property Values And Taxes

Property Tax Relief Calculator Office Of The Controller

Multnomah County Property Tax Guide Travis County Assessor Rate Payments Search More

Why Are Homes On Corner Lots Charged More For Property Taxes Than Houses Located Between Two Other Properties Quora

Oregon Income Tax Calculator Smartasset

Michigan 2023 Sales Tax Calculator Rate Lookup Tool Avalara

100 Best Tax Blogs To Read In 2024

How Do I Calculate The Value Of A Pension Financial Samurai

Georgia Property Tax Calculator Smartasset

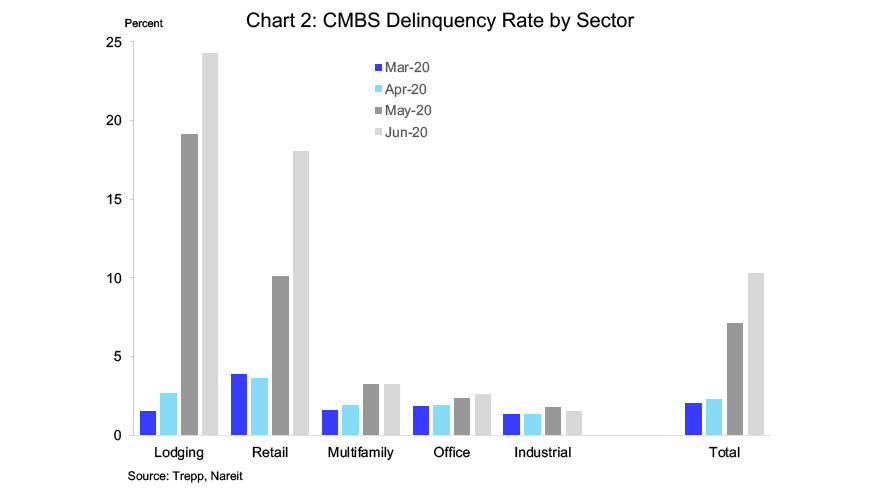

Cmbs Delinquencies Continued To Climb In June Nareit

Rhode Island Property Tax Calculator Smartasset

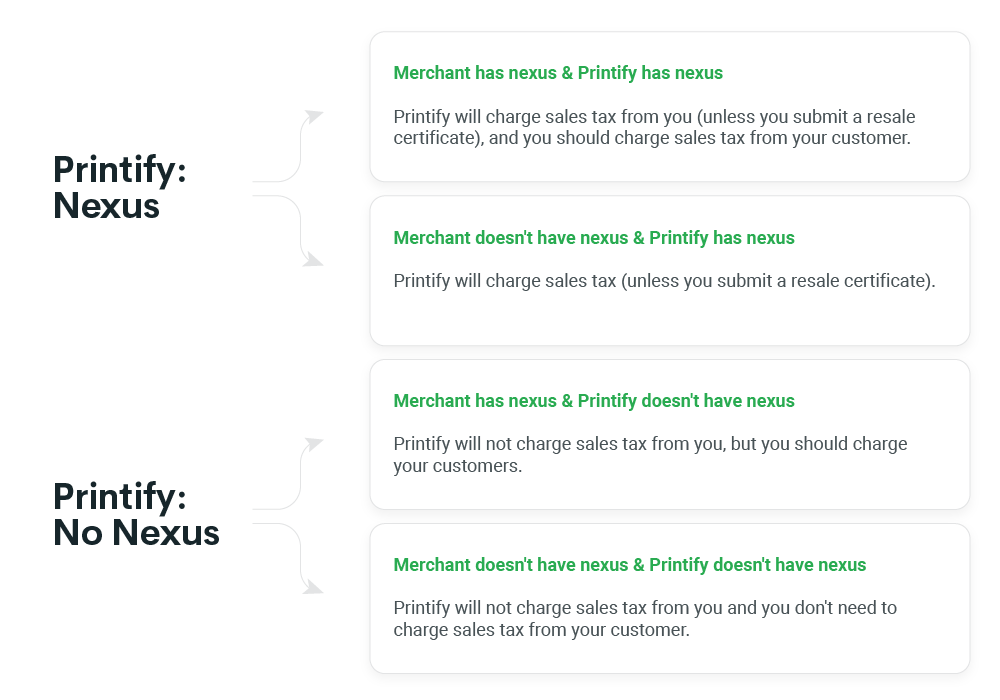

Understanding Sales Tax With Printify

King County Property Taxes Increasing Pricing Some Out R Seattlewa

Pay Personal Property Tax

Understanding Your Property Tax Bill Clackamas County