How much can i borrow on an fha loan

Search For Calculate Fha Mortgage at Discoverthebestco. Similar to regular FHA loans they tend to be enough for most families.

Let S Talk Loan Options Fha Loan Total Mortgage Blog

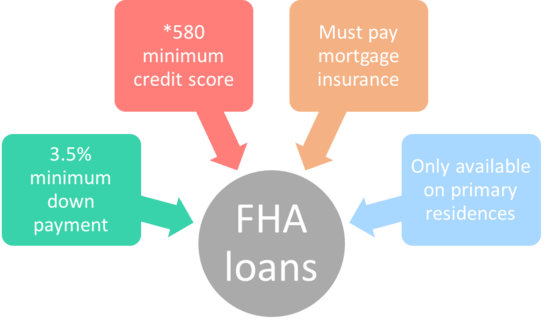

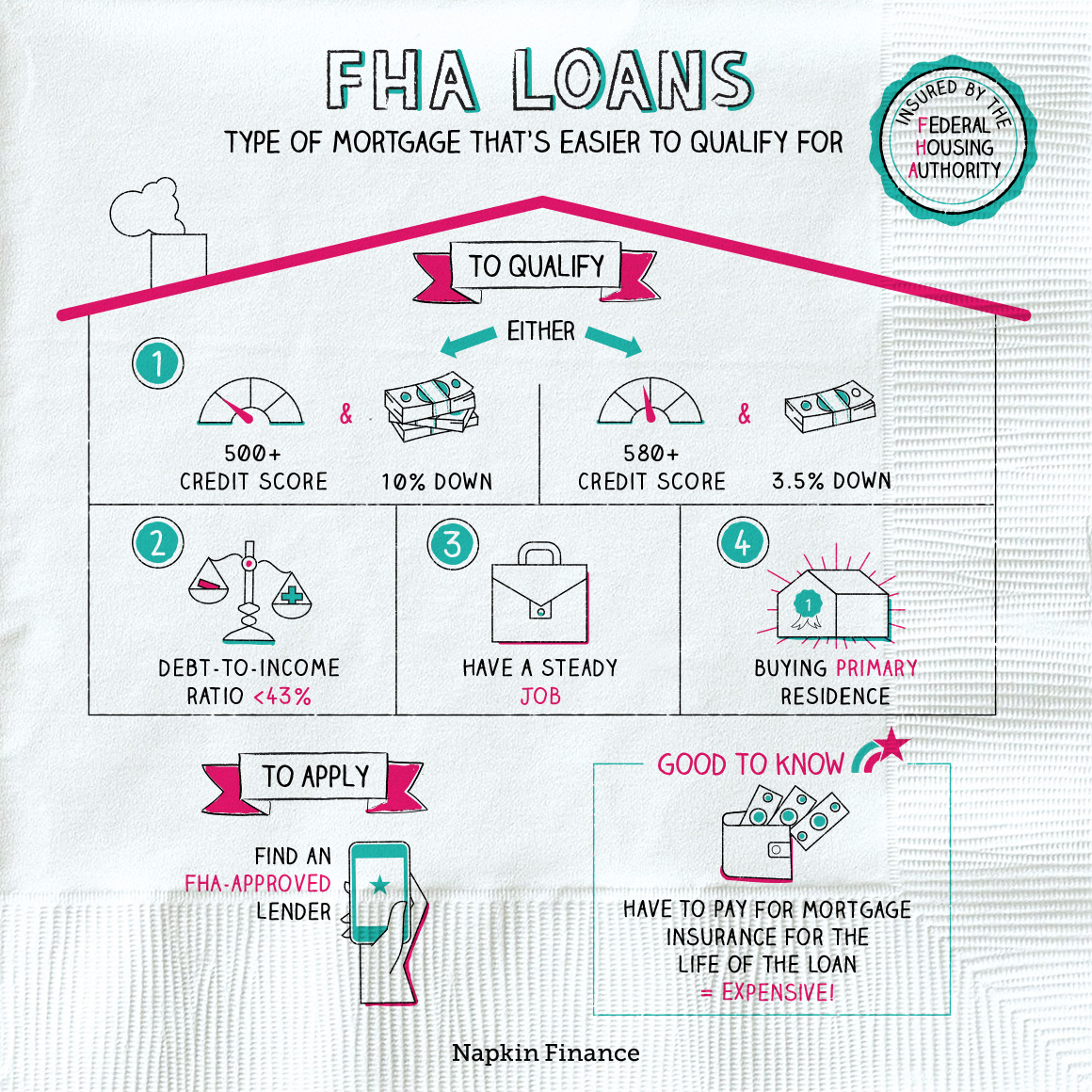

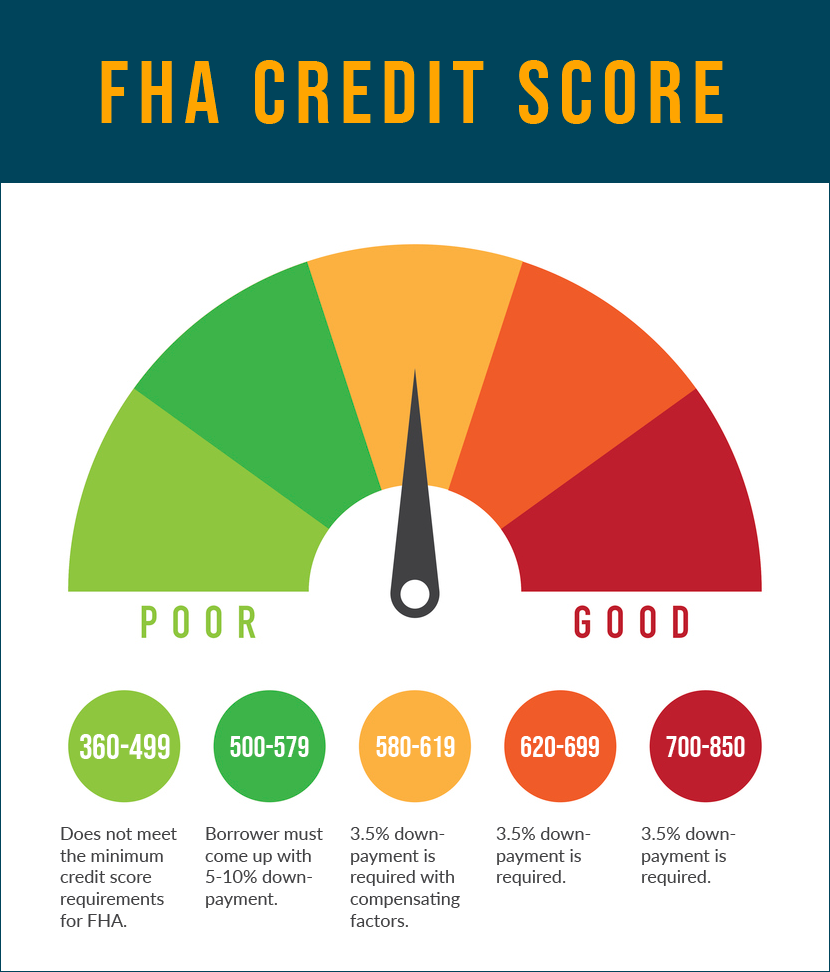

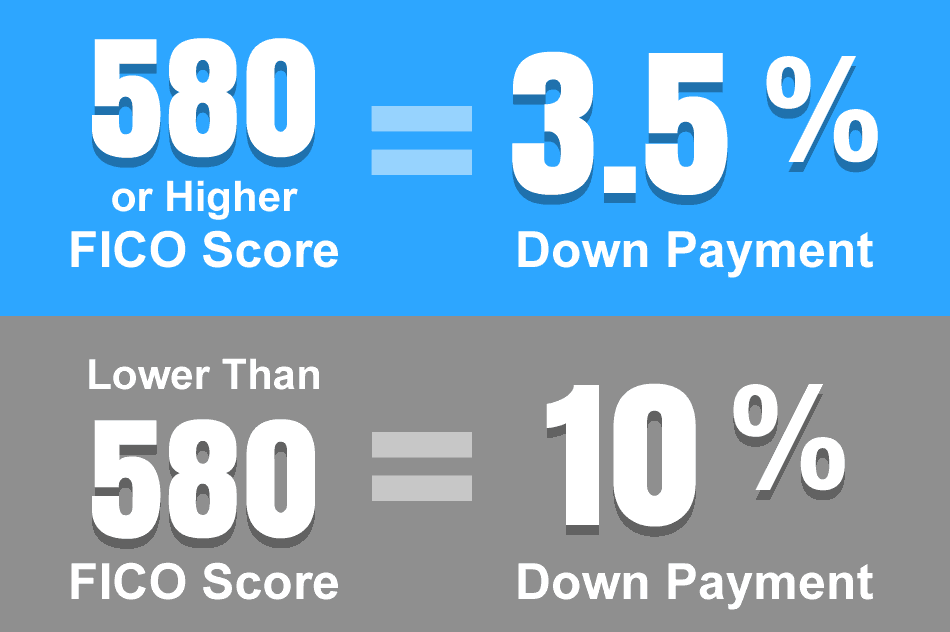

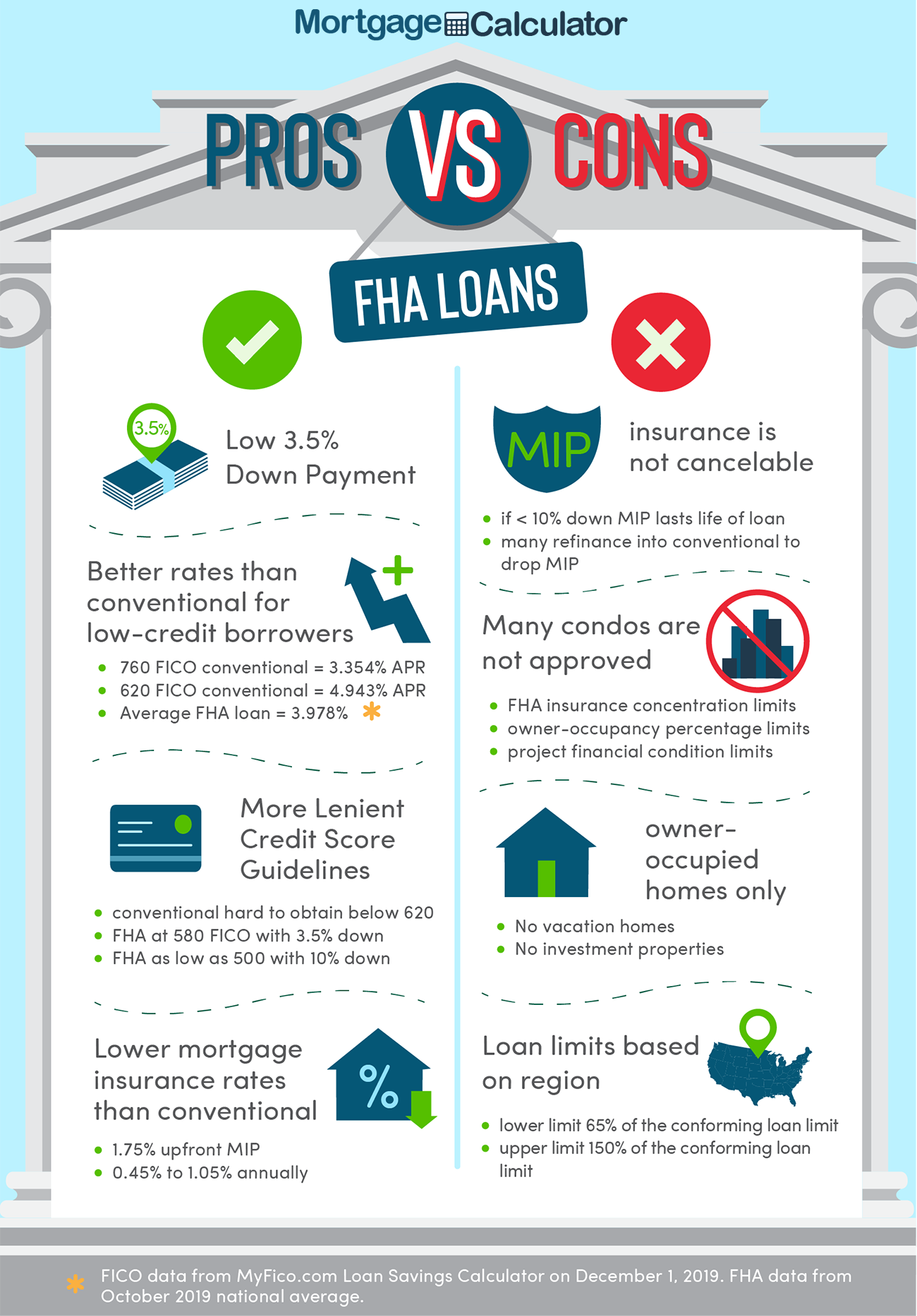

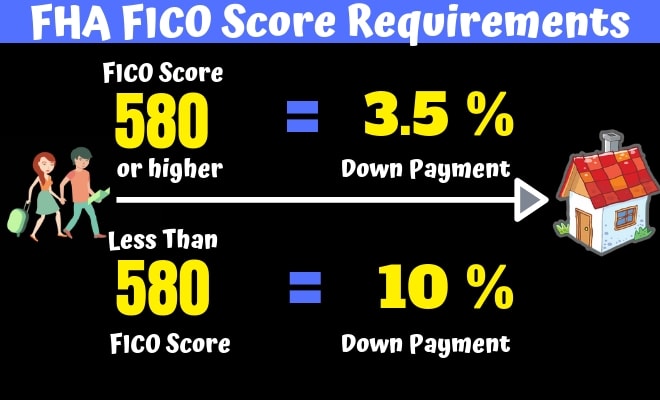

FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases.

. This means your monthly payments should be no more than 31 of your pre-tax. The MIP displayed are based upon FHA guidelines. Does Quicken Loans Do Construction Loans Getting A Fha Mortgage The Federal Housing Administration fha insures hecm reverse mortgages on properties valued up to.

How much can i borrow ona fha loan by Selina Beahan V Published 1 year ago Updated 4 weeks ago The FHA loan limit floor is 65 of the conforming loan limit or 420680 for most. Apply Quickly And Get Approved In 24hrs. A minimum of 5000 must be borrowed and maximum limits are set by the FHA that differs according to locations.

That applies to single-family homes with limits. Loan limits are the maximum amount a person can borrow on a mortgage. Ad Best FHA Loan Lenders Compared Rated.

Enter the total gross monthly income youll be using for qualifying. Ad Get The Service You Deserve With The Mortgage Lender You Trust. FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases.

Looking For A Mortgage. What is the maximum amount you can borrow for an FHA loan. Other loan programs are.

Were Americas 1 Online Lender. The FHA Loan Limits. Looking For A Mortgage.

4 rows In low-cost markets the FHA loan limit is 65 of the conforming loan limit in the county. Dont Settle Save By Choosing The Lowest Rate. Get Your Estimate Today.

Therefore 6500 x 43 2785 that is the total monthly. Ad Find Calculate Fha Mortgage. The 2022 FHA loan limits for single-family homes reflect an 18.

Ad Get The Service You Deserve With The Mortgage Lender You Trust. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Down Payments As Low As 35 No Income Limits One Step Closer To Owning A Home.

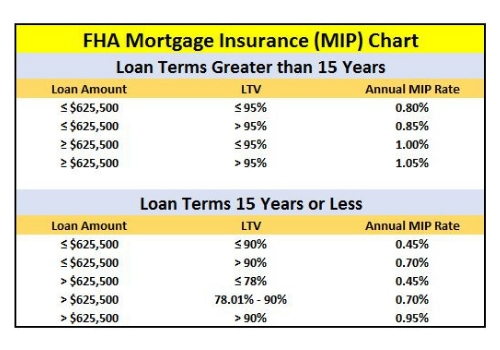

With Low Down Payment Low Rates An FHA Loan Can Save You Money. In 2018 loan limits on fha mortgages range from a floor of 294515 to a ceiling of 679650 in the lower 48 states. The MIP displayed are based upon FHA guidelines.

Determining the FHA loan limits in your area is the least complicated component of how much you can borrow with a 203K loan. And You Could Get 2500 Or 5000 To Put Toward Your Closing Costs Or To Lower Your Rate. See If You Qualify for Lower Interest Rates.

The FHA loan max or ceiling in high-cost areas is 970800 this is 150 of the conforming loan limit. In most parts of the country the limit is currently set at 625500. This means your combined debts should use no more than 43 of your gross monthly income after taking on.

Lets take a borrower with a gross monthly income of 6500. Borrowers can exceed this. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. In general according to the FHA loan handbook HUD 40001 A Mortgage that is to be insured by FHA cannot exceed. Ad First Time Homebuyers.

Were Americas 1 Online Lender. Ad Check FHA Loan Eligibility Requirements. Other loan programs are.

Lock Rates For 90 Days While You Research. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. Generally the most you can borrow with an FHA loan is 420680.

You can use an FHA loan to buy a single-family home or a multi-family home for up to four families. You can borrow as much as your local FHA loan limit but no more than that. The general rule for FHA loans is 43 debt-to-income ratio.

Include any commissions bonus pay and other taxable. Its A Match Made In Heaven. How to use our how much can I borrow mortgage calculator.

Maximum loan amounts for FHA refinance loans may depend on several factors including how long you have owned the. Its A Match Made In Heaven. Get Your Estimate Today.

The answer is found. FHA Maximum Loan Amounts For Refinance Loans. With a FHA loan your debt-to-income limits are typically based on a 3143 rule of affordability.

There are multiple factors that can affect the loan amount. As per the HUD guidelines the DTI of this borrower should not be above 43. For an FHA loan your DTI ratio should be 43 or lower.

Take the First Step Towards Your Dream Home See If You Qualify. FHA loan rules require a minimum 35 down payment so you can approximate how much money down you will need by doing the math based on the maximum loan amount.

Is An Fha Loan Good For You Stem Lending

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Loans Complete Guide For First Time Homebuyers Credible

Fha Loans Everything You Need To Know

Fha Loan Requirements And Guidelines

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loans Napkin Finance

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Requirements Rates California 3 5 Down Payment E Zip Mortgage

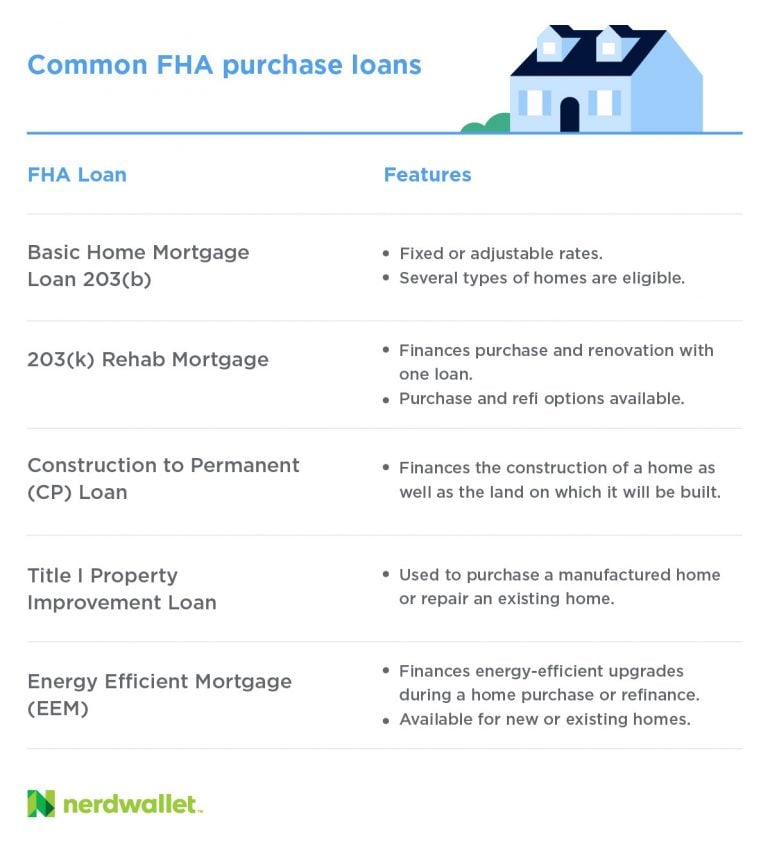

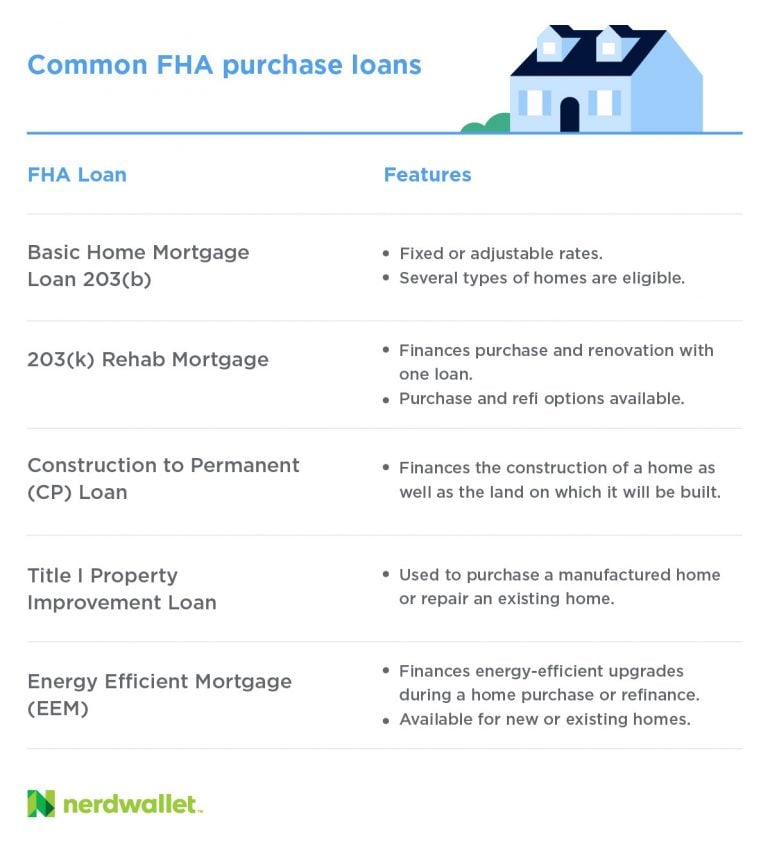

Fha Loan What To Know Nerdwallet

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loans Your Complete Guide Loanry

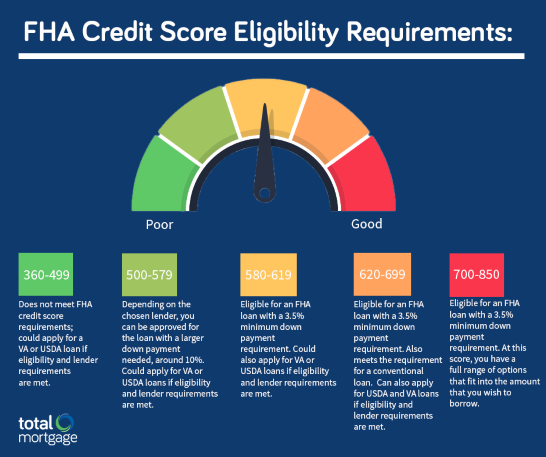

Minimum Credit Scores For Fha Loans

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Requirements For 2022 Complete Guide Fha Lenders